Copyright © 2017 U.S. Gambling Refund. All Rights Reserved.

Taxes On Jai Alai Winnings

Jai Alai Winners: Reclaim The IRS Tax On Jai Alai Winnings

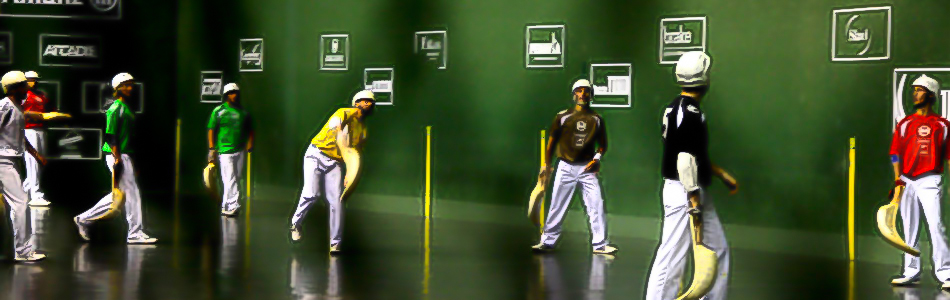

Where Is Jai Alai Played?

Jai alai is a traditional Basque sport and is traditionally played in Hispanic areas. In the United States, jai alai is only played in Florida. There are currently six jai alai frontons (courts) scattered throughout Florida's major cities. There is pari-mutuel betting at the Florida jai alai frontons. Jai alai was also played in New England and Nevada, but unfortunately those US frontons have been closed. There have been plans to reintroduce jai alai in the Hartford, Connecticut area.

Are Jai Alai Winnings Taxed?

Yes, the IRS taxes jai alai. The jai alai tax is similar to the taxes on horse racing, and the taxes on dog racing. 30% of your gambling winnings are withheld by the IRS when certain conditions are met.

Jai alai winnings are taxed at 30% when both of the following criteria are satisfied:

* The jai alai win is at least $600 USD above the initial wager; and

* The jai alai win is at least 300 times the amount of the initial wager.

Thus, if you bet $2 USD and win $600 USD, you will not have to pay any taxes on jai alai as the jai alai winnings minus the initial wager ($600 USD subtract $2 USD = $598 USD) is smaller than the threshold of $600 USD for jai alai taxes.

If you bet $3 USD and win $750 USD, you will also not have to pay any taxes on the jai alai winnings either. Even though the jai alai winnings minus the initial wager ($750 USD subtract $3 USD) is greater than the $600 USD threshold, the jai alai win is less than the 300:1 ratio.

Despite the previously outlined IRS rules for taxation at most US jai alai venues, the IRS also mandates jai alai frontons run by Indian tribal governments in the United States to assess the 30% jai alai tax on all jai alai winnings (without the need to meet a specified threshold or ratio) for US non-residents.

Can I Get My Withheld Jai Alai Taxes Back?

So, you have won big at jai alai, and have had jai alai tax taken from your jai alai winnings. What can you do now? Are you expected to just settle with the US government taking 30% of your jai alai win? As a Canadian, you are in luck. Part or all of your jai alai taxes can be refunded by the IRS if you have US gambling losses in the same taxation year as your jai alai win.

Assuming you have won $2000 USD at a Florida jai alai fronton. The IRS will impose a jai alai tax of 30%, or $600 USD ($2000 USD X 30% jai alai tax rate), leaving you with $1400 USD ($2000 USD subtract $600 USD) to take home. Any U.S. gambling losses can be used to deduct against your jai alai winnings. It does not have to be limited to jai alai losses. Acceptable forms of gambling losses include losses in slots, table games, lotteries, horse racing, dog racing, etc., in addition to jai alai. If your gambling losses are $2000 USD or more in the same taxation year, you will have the entire amount of jai alai taxes refunded.

If your gambling losses are $1000 USD, for example, you will have that amount deducted from your jai alai win ($2000 USD subtract $1000 USD), and you will then be taxed on the remainder ($1000 USD X 30% jai alai tax rate). Your reduced taxes will be $300 USD, as opposed to the original $600 USD. Since your jai alai taxes were withheld at the time of your jai alai win, you can anticipate a tax refund for the difference of $300 USD.

When you apply to have your jai alai taxes refunded, the IRS does not require you to submit proof of your gambling losses. However, they may ask you to justify them at a later date. Thus, you should always keep old lottery tickets, betting stubs, and records of the time, place, amounts won/lost, and type of gambling activity you engaged in while in the United States.

International visitors from treaty countries gambling on jai alai do not need to record gambling losses. If you are from a treaty country, you can apply to receive a full IRS tax refund. Foreign visitors from non-treaty countries will need to claim their US gambling losses against their jai alai winnings for a full or partial gambling tax refund.

How Can U.S. Gambling Refund Help Jai Alai Winners?

The IRS tax codes are infamous for their complexity. US non-residents are often frustrated with the tax rules and the tax refund process. US Gambling Refund and its associates have several decades of experience with the IRS. We are knowledgeable of both US and Canadian tax systems, thus allowing gamblers to enjoy their winnings in full.

If you are a Canadian or an international gambler and have had jai alai taxes withheld, contact us to obtain a tax application package. We can help you recover your withheld jai alai winnings from the IRS. Click the link below to start the refund process and recover your withheld jai alai taxes.